Everything you need to know about TGAP waste in 2025

What is TGAP on waste?

The TGAP (Taxe Générale sur les Activités Polluantes – General Tax on Polluting Activities) was introduced in 1999 and operates according to the “Polluter Pays” principle. Its purpose is to encourage players such as local authorities and businesses to reduce the quantity of waste they produce, and to improve recycling and recovery, by taxing each tonne of hazardous or non-hazardous waste received by waste storage (landfill) or thermal treatment (incineration) sites.

The national target is to reduce the tonnes of waste landfilled by 50% by 2025 compared with 2010. In 2010, some 19.47 Mt of non-inert, non-hazardous waste was landfilled, setting the target for 2025 at 9.73 Mt.

Since 1999, the TGAP tax on waste has been rising, reaching its peak in 2025. For the following years, this rate is not expected to increase, apart from an increase linked to inflation.

How much will the TGAP on waste cost in 2025?

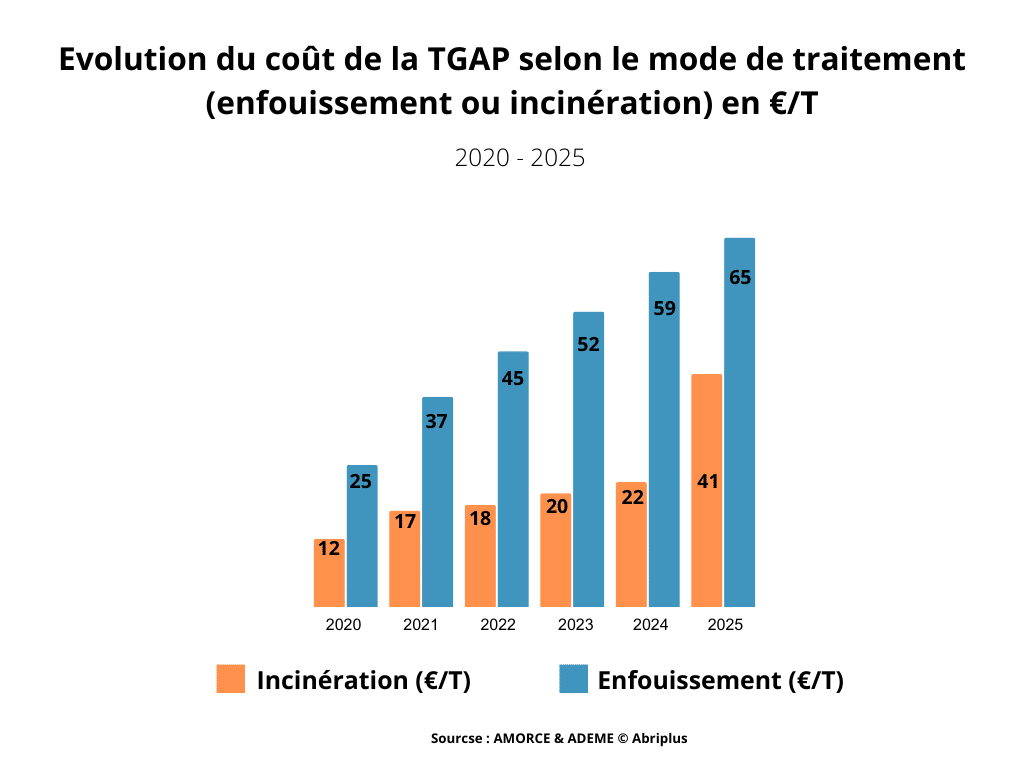

In 2025, the TGAP on waste will reach the maximum increase planned since 2019. TGAP on waste will cost €65 per tonne for waste received at landfill sites, and €41 per tonne for waste destined for incineration.

It will therefore rise from €12 per tonne to €41 per tonne between 2020 and 2025 for incinerated waste, and from €25 per tonne to €65 per tonne for landfill waste.

From January 2025, this tax may be increased by €5 to €10 per tonne for any non-hazardous waste landfill facility (NHWF) that exceeds the annual target of halving landfill disposal between 2010 and 2025.

The maximum tonnage for each site will be determined by the Regional Prefect before October 31st of the previous year(Ministerial Decree of October 23, 2023).

What types of waste are covered by the TGAP?

Hazardous waste: containing toxic substances or presenting risks to health or the environment.

Non-hazardous waste: such as household waste, plastics, untreated wood, paper, cardboard, unsoiled packaging, rubble…

Exemptions: recovered or recycled waste, inert or non-recoverable waste, previously taxed waste and waste from exceptional events.

In short, all household and business waste sent to landfill or incineration is taxed by the tonne.

For example, in the Île-de-France region, ORDIF notes: “In 2022, residual household and similar waste will still represent over 4 million tonnes (mainly household refuse), sent mainly for incineration. With putrescible waste and recyclable packaging accounting for more than 50% of household waste, the reduction potential is 141 kg/capita.

Local authorities therefore have a clear interest in transferring these flows, which alone represent almost 21 million euros in TGAP, to more environmentally and economically virtuous treatment methods”. ( ORDIF “TAXE GÉNÉRALE SUR LES ACTIVITÉS POLLUANTES MAJORÉE : LE COEFFICIENT RÉGIONAL PUBLIÉ”)

Who is affected by the TGAP increase in 2025?

Who pays TGAP on waste?

- Operators of facilities classified for environmental protection (ICPE) that store or thermally treat waste.

- Companies transferring waste abroad

- Waste treatment operators

However, waste producers such as local authorities and businesses are indirectly invoiced for this tax via the treatment costs that are included by the service providers in the final bill.

So local authorities and businesses have a direct financial interest in reducing the tonnages of waste sent to incineration plants, and even more so to landfill sites.

How can we reduce the cost of TGAP in 2025 and beyond?

The main way for local authorities and companies to reduce the weight of the TGAP in treatment bills is to reduce the tonnages sent out!

- By encouraging individuals/employees to produce less waste: avoid using single-use plastic materials, reduce the proportion of packaged products, pay attention to food waste (establish menus before shopping, for example).

- By setting up selective sorting systems, accompanied by educational material on the benefits of sorting, recycling instructions and appropriate equipment. The fact is, refuse garbage cans still contain a very large proportion of waste that could have been recycled or recovered.

These are the findings of the “Déchets chiffres-clés 2024” study published by ADEME. Nearly 80% of the so-called “grey” waste could be recycled or recovered!

And whether you’re sorting at home, at the bottom of your block of flats, on the street or in your company, sorting equipment is a vital element in the success of the scheme.

Abriplus has designed a sorting bin shelter and a container shelter specially adapted to enable users to sort with the least possible effort. For putrescible waste, it may be worth considering on-site composting, which avoids transport costs and quickly generates positive spin-offs. Abriplus has several solutions for you: more info…

Share this article